October Market Update

Hi Everyone,

Happy Halloween! We hope your weekend brings plenty of treats, and that you still have some tricks up your sleeve, too!

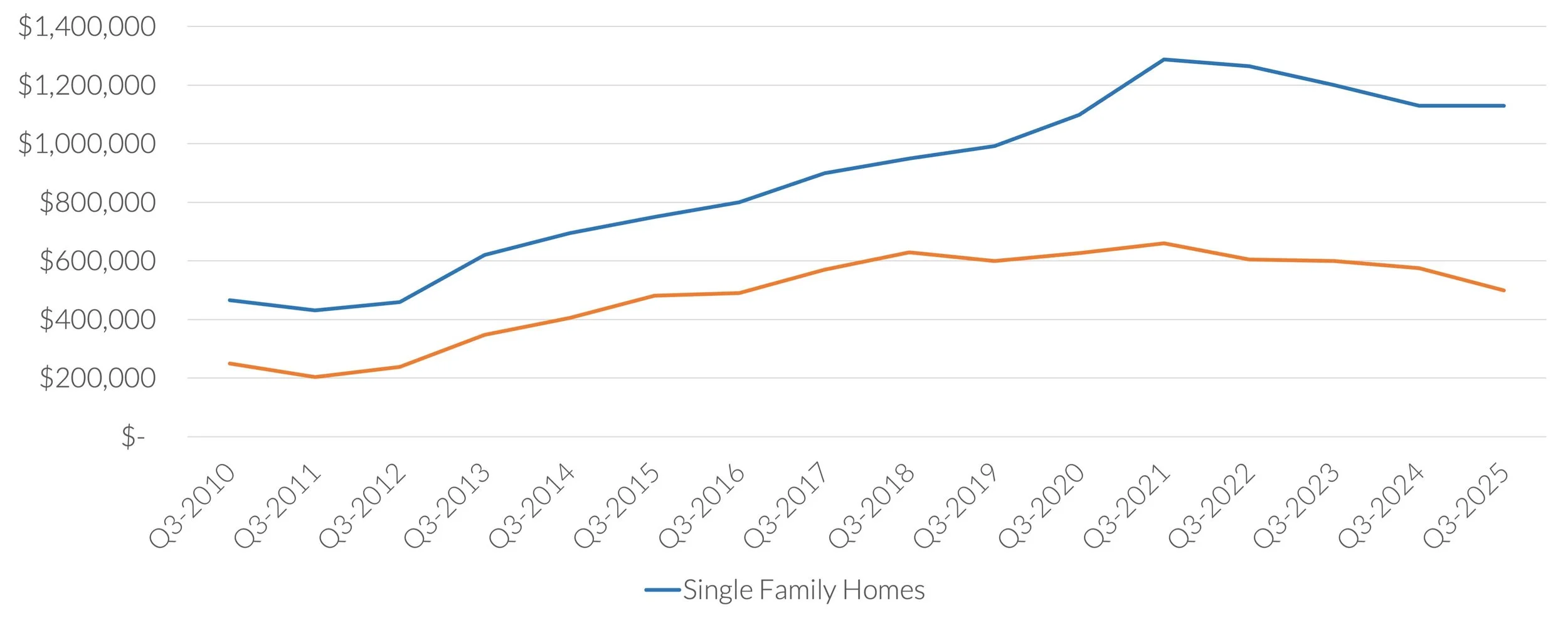

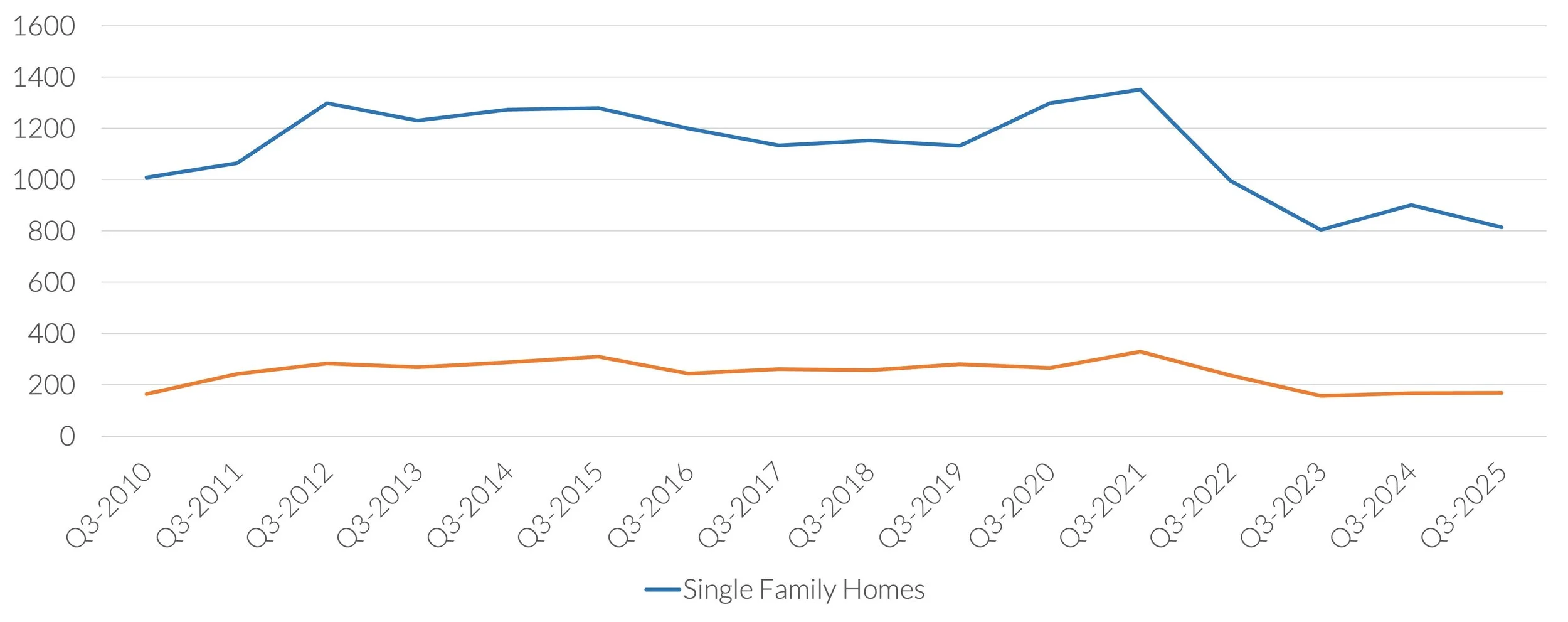

We wanted to share some highlights from the Inner East Bay’s Q3 market trends (see the graphs below). With mortgage rates easing a bit this month and inventory still low, the market has remained steady overall.

Well-presented homes in good condition, with smart layouts, continue to sell quickly—often with multiple offers. Properties with standout features such as architectural pedigree, exceptional outdoor space, great views, or high-end finishes are still surpassing expectations. Some homes do take a little longer to find their perfect buyer, but overall the East Bay remains in demand, and homes continue to sell much faster than in many other regions.

Our listings have performed strongly this fall, and we’re so grateful to be able to draw on our collective experience navigating many different market cycles. That broader perspective helps us guide our clients strategically and thoughtfully—from preparation and pricing to marketing and of course, negotiation.

As always, we’re here for all your real estate needs. It’s never too early to connect if you’re considering a move!

Warmly,

Maria, Corey, Anita, and Carla

OUR ACTIVE & JUST SOLD LISTINGS

JUST LISTED!

2+ beds, 2 baths, 1098 sf (per public record)

Urban Retreat: Bungalow with Guest House and Garden Oasis

JUST LISTED!

2+ beds, 1.5 baths, 1118 sf (per measured floorplan)

Discover the potential in this charming home, located on a desirable corner lot

in Oakland’s vibrant Temescal neighborhood!

INNER EAST BAY MARKET UPDATE

Q3 2025 WRAP-UP

The Inner East Bay continued to demonstrate momentum despite constrained inventory and selective buyer behavior.

On Wednesday, the Federal Reserve cut borrowing costs for the second time in a row. While the Fed doesn't directly set mortgage rates, homebuyers could benefit if the expectation of future cuts puts downward pressure on rates. The already lower rates this fall have led to more optimism among both buyers and sellers.

Single-Family Homes

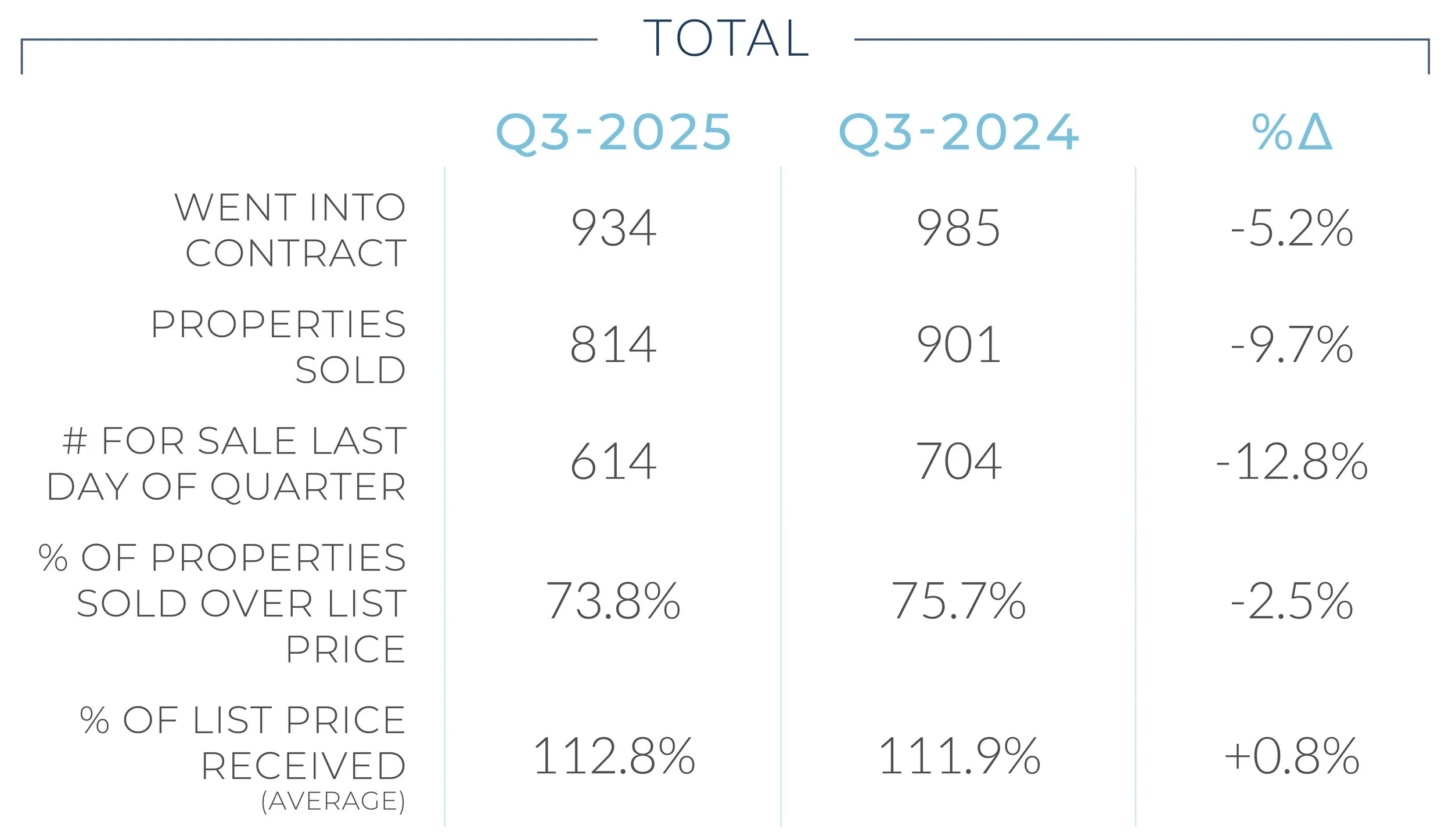

The single-family segment held steady year over year, underscoring its stability even amid lower supply. The median sales price remained unchanged at $1,130,000*, while homes continued to sell quickly with a median of 15 days on market. Price per square foot dipped slightly by 1.4% to $685, suggesting modest recalibration rather than weakening demand.

Contract and closing volume eased slightly, with 934 homes going into contract (down 5.2%) and 814 sold (down 9.7%), a reflection of limited new listings rather than diminished interest. 73.8% of homes sold over asking, and sellers received an impressive 112.8% of list price on average, marking a small gain over last year. With months’ supply of inventory at 2.2, the market remains firmly in seller territory.

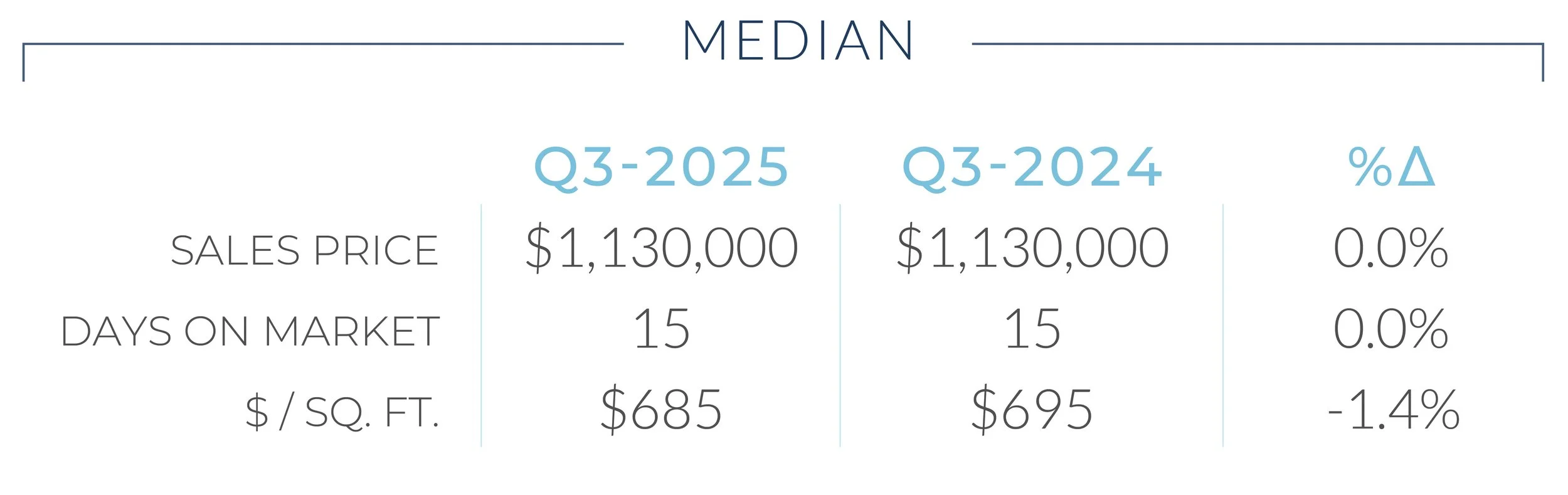

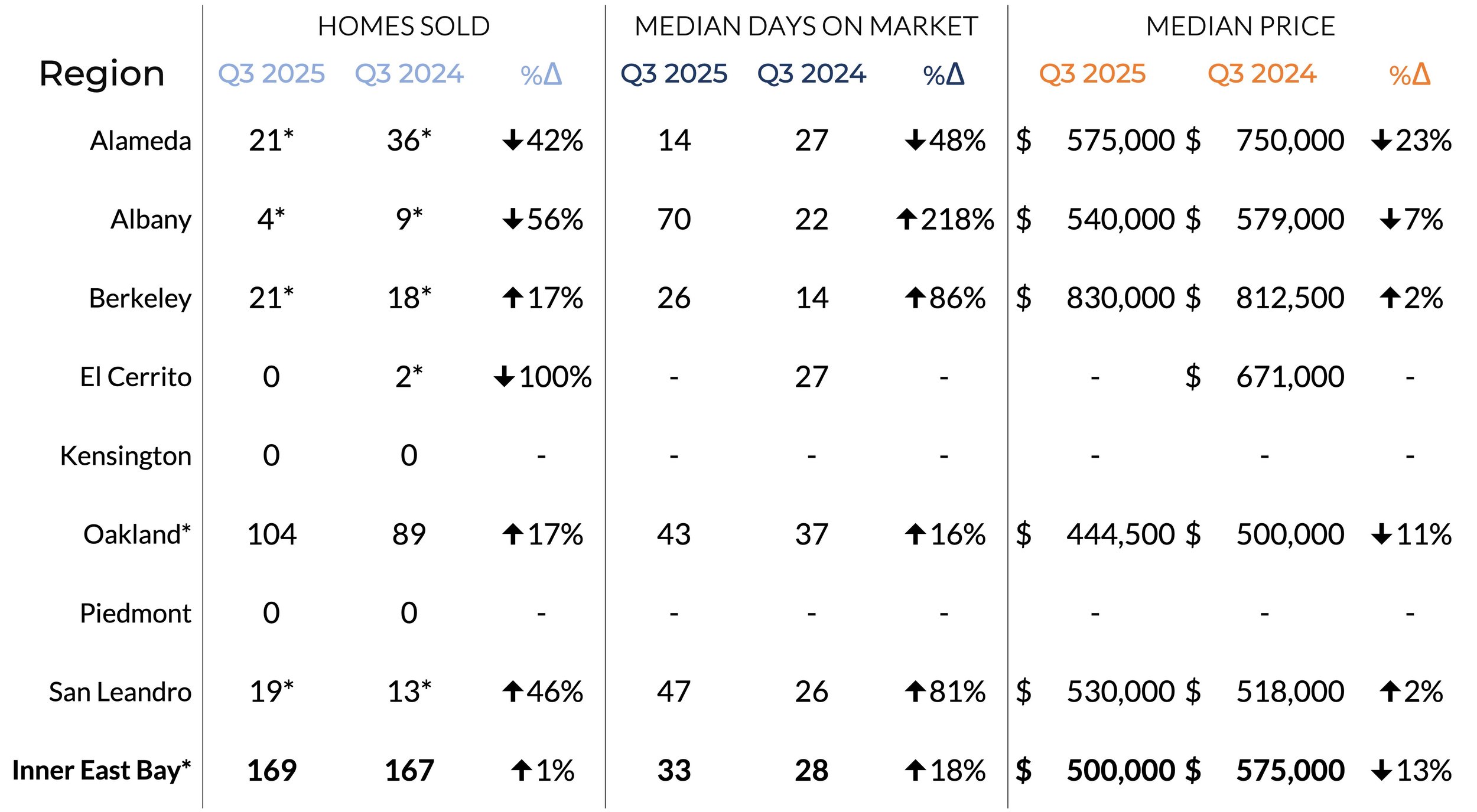

Condominiums

The condo market showed a more mixed but improving picture. The median sales price declined 13.0% to $500,000*, while the median price per square foot fell 9.6% to $508. Median market time lengthened modestly to 33 days, signaling more breathing room for buyers.

Encouragingly, 208 condos went into contract (up 8.3%) and 169 closed (up 1.2%), showing renewed demand as affordability improves. Active listings dropped sharply — down 55% year over year — keeping the market from tipping too far in favor of buyers. About 33.7% of condos sold over asking, and sellers achieved 100.7% of list price on average, indicating steady traction for well-presented properties.

Market Outlook

Overall, the Inner East Bay continues to demonstrate strong fundamentals: quick-moving single-family homes, a reawakening condo sector, and a steady influx of motivated buyers drawn by easing interest rates and limited supply. As fall progresses, conditions are aligning for a competitive yet opportunity-filled close to 2025.

*Please note that this is a broad metric for the whole Inner East Bay. For more detail or to see how your specific neighborhood is performing, please reach out to us directly.

YEAR-OVER-YEAR COMPARISON

SINGLE FAMILY RESIDENCES

MONTH-OVER-MONTH COMPARISON

SINGLE FAMILY RESIDENCES

CHANGE IN PAST MONTH:

SALES PRICE

+6.8%

DAYS ON MARKET

-3 days

MEDIAN AREA VALUES

SINGLE FAMILY RESIDENCES

Q3 2025

** Denotes small sample size; Use caution when interpreting results.

YEAR-OVER-YEAR COMPARISON

CONDOMINIUMS

MONTH-OVER-MONTH COMPARISON

CONDOMINIUMS

CHANGE IN PAST MONTH:

SALE PRICE

-6.4%

DAYS ON MARKET

-5 days

MEDIAN AREA VALUES

CONDOMINIUMS

Q3 2025

** Denotes small sample size; Use caution when interpreting results.